Consejos de Reparación

Safe Credit Solutions es una empresa de Reparación y restauración de Crédito, comprometida a ayudar a nuestros clientes a mejorar su calificación crediticia.

Artículos Sobre Reparación de Crédito

¿Cuánto tiempo permanece una deuda en el historial crediticio?

Cuando se trata de manejar nuestras finanzas personales, el historial de crédito juega un papel fundamental. Este informe refleja tu comportamiento financiero y puede impactar

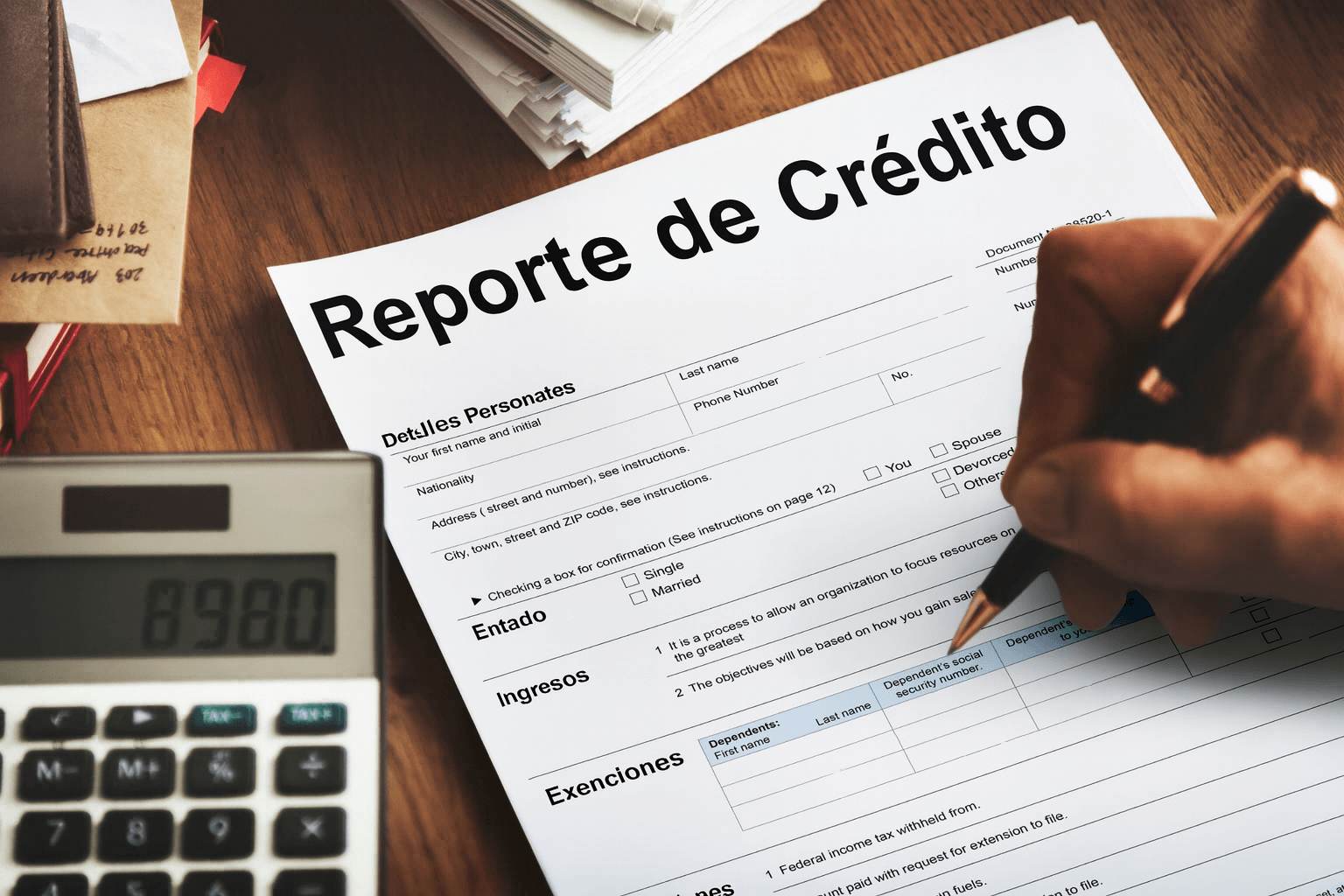

¿Cómo leer y entender tu reporte de crédito?

Tener un buen historial crediticio es esencial para abrir puertas en Estados Unidos. Desde obtener una hipoteca a un buen interés hasta acceder a tarjetas

¿Cuándo conviene contratar una empresa para limpiar tu crédito?

Una de las preguntas más comunes entre quienes tienen problemas de crédito es si es mejor intentar resolverlo por su cuenta o contratar a una

¿Existe un límite en la cantidad de veces que un cobrador de deudas puede llamarme?

Sabes que tienes deuda para pagar. Lo estás intentando, pero está tardando más de lo que esperabas. Con sus facturas habituales, como el alquiler, el pago

Cómo tratar con los cobradores de deudas cuando no puede pagar

Nadie quiere endeudarse. No importa la razón por la que te encuentres en esta situación, puede resultar abrumador no estar seguro de la salida. No

Hasta 1 millón de personas no pueden pagar la deuda de sus tarjetas de crédito

Según los datos de la Asociación de Bancos de Turquía, el año 2013 presenció un preocupante fenómeno: el 55% de un millón de personas no

7 consejos efectivos para reparar tu crédito: cómo elegir la empresa adecuada en Miami

En el panorama financiero actual, se requiere un buen crédito para obtener préstamos, hipotecas e incluso alquilar un apartamento. Sin embargo, mantener un puntaje perfecto

¿Cómo reparar tu puntaje de crédito rápidamente? Consejos y trucos

Resumen: En este artículo compartimos consejos y trucos valiosos para ayudarte a reparar tu puntaje de crédito de forma rápida y efectiva. ¿Tienes un puntaje

Mejores empresas de reparación de crédito en Miami

Resumen Esta guía explora las mejores empresas de servicios de reparación de crédito en Miami para restaurar tu puntaje de manera efectiva. Introducción Encontrar los

¿Cómo mejorar tu puntaje de crédito rápidamente?

Resumen: En esta guía completa, exploraremos cómo puedes mejorar tu puntaje de crédito rápidamente con Safe Credit Solutions Inc., la empresa líder de reparación de

¿Deberías usar un servicio de reparación de crédito?

Resumen: Esta guía analiza los beneficios clave de los servicios de reparación de crédito, qué hace excelente a una empresa y cómo decidir si es

¿Cuál es la mejor forma de arreglar tu crédito?

Resumen: En esta guía completa, exploraremos la mejor manera de reparar tu puntaje de crédito con Safe Credit Solutions Inc. Introducción Cuando tienes mal crédito,

Que podemos hacer por ti

Nuestros Servicios

Asesorías personalizadas, disputa de cuentas negativas y sistema de seguimiento del trabajo.

Disputa De Marcas Negativas

En Safe Credit Solutions realizamos la disputa de las marcas negativas de los reportes de…

Asesoría Personalizada

En Safe Credit Solutions nos comprometemos con nuestros clientes a brindarles una consulta personalizada, donde…

Sistema De Seguimiento Del Trabajo

Nuestra empresa cuenta con programas y un equipo de trabajo especializados que se encargan de…

Número ITIN

Disputa de cuentas negativas, asesorías personalizadas, sistema de seguimiento del trabajo y Número ITIN, Descubre…